THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Student loans are a big reason why so many people cannot get ahead financially.

With large monthly payments for years to come, many are finding it tough to get by.

And recent studies have shown the scary statistics of student loan debt as the fastest growing debt!

If you are struggling with your student loans, you are looking for help.

Fortunately, there are things you can do to pay off your student loans faster than you think.

And many of these things you can start doing today.

If you are willing to take action, you will begin to see the amount of student debt you owe drop.

And in some cases, you will even free up money every month.

Here are 12 creative ways to pay off student loans starting today.

Table of Contents

12 Smart Tips To Pay Off Student Loans

Before you can try to use any of these tips to help you with your debt, you first have to know one thing.

Are your student loans federal student loans or private student loans?

This is important as there are different programs for each.

While this does make the job of paying off your debt a little harder, in the end, knowing this upfront will save you many headaches later on.

#1. Ask For Employer Help

One of the smartest options for how to tackle student loans is through your employer.

Many employers are now offering this as a benefit just like with retirement contributions and health insurance.

The most common way this works is each year you are employed, your employer will give you money to put towards your loans.

Another method is through matching contributions.

Here your employer will match what you pay, up to a certain amount.

Of course, each employer is different, so be sure to ask about the details.

And if you are negotiating a salary, try to work this option in to the deal.

While it would be great to have a larger salary, knowing that you have help with your student debt will take away a lot of stress.

#2. Public Service Forgiveness

If you are employed in the public sector, there are student loan forgiveness programs you can and should take advantage of.

Teaches, health care workers, police officers, and firefighters are examples.

Each program has its own requirements, so be sure to read through everything carefully.

Here is a short list of the most popular student loan forgiveness programs.

Note that many of these apply only to federal loans.

- Teacher Loan Forgiveness Program

- Public Service Loan Forgiveness:

- Perkins Loan cancellation and discharge

- John R. Justice Student Loan Repayment Program

- Faculty Loan Repayment Program (FLRP)

- Indian Health Services Loan Repayment Program

- National Health Service Corps

- National Institutes of Health (NIH) Loan Forgiveness

- NURSE Corps Loan Repayment Program

Additionally, each state has their own programs to help with student debt.

Here is a link to a breakdown by state for you to look into.

Be sure to research for other programs as well, as you may qualify for more than one.

#3. Consolidate Your Loans

If you have more than one student loan, you can consolidate them into one loan.

Doing this make repayments easier since you will only have one payment to make each month as opposed to many.

When it comes to saving money with consolidation loans, you have a few options.

You can choose to change the repayment period to a shorter or longer term.

A shorter repayment term means your monthly payment will be higher, but you will save on interest.

A longer repayment term means your monthly payment amount will be lower, but you will pay more interest in total.

Of course, there is a chance where you get a low interest rate that both shortens the period and saves on interest.

Your first choice should be to contact your lender to see if they are open to consolidation.

Even if they are, your next choice should be Credible.

They will give you free quotes from up to 10 lenders. This will allow you to compare the best offer for you.

Click the button below to see how much money you can save with Credible.

#4. Refinance

Another option is to refinance your student loan debt.

Doing this gets you a lower interest rate than you are paying now, saving you money.

As with consolidation, your first choice should be with your lender to see what they offer.

From there, check with Credible to make sure the offer is competitive.

The interest rate you qualify for depends on your credit score.

So make sure you have taken the steps to improve your credit first.

It’s easy to do, and something that can save you thousands in interest on your student loans.

#5. Pay Ahead

If you are still in school, consider making payments on your debt now.

Most student loans don’t start accruing interest until after you graduate.

By making payments now, you will have a smaller loan balance when interest starts accruing.

As a result, you will pay less interest in total.

Of course, you need to make sure you understand the terms of your loan.

In some cases, paying early like this will end any grace period after you graduate.

If you are not in school, you can still pre-pay.

Just make larger than the minimum payment. This will ensure you save money in interest.

#6. Pay Strategically

If you have a lot of loans, don’t just make one payment every month.

Take the time to review each loan.

What is the minimum monthly balance due? What is the total balance? What is the interest rate?

Knowing this information will help you to make a plan to reduce your student loan debt faster.

For example, you can pay the minimum on the larger debts and put extra money towards the smaller debt.

This will help you to get rid of your student loan fast and free money up for the remaining loans.

#7. Public Service Loan Forgiveness

As I mentioned earlier in this post, some public service jobs allow for loan forgiveness.

It works by having a full time job for a certain number of years.

After you meet those criteria, you student loan will be forgiven after a period of time.

Usually, the time frame is 10 years.

And during this time, you are making regular payments on your debt.

Also note that not all student loans qualify for loan forgiveness, so make sure yours is eligible.

If you don’t work in a public service job, you can still have your student loans forgiven.

For example, you can volunteer with Peace Corps or Americorps.

After you complete your term of service, you use the stipend towards your student loan debt.

While most people won’t be able to pay off their student loans this way, it is a way to pay off a few thousand dollars.

#8. Sign Up For Auto Pay

Many borrowers are finding it hard to make their monthly payments on time.

This is a serious issue for the private student loan companies since they use the monthly payments to run their business.

As a result, they started to offer discounts if you sign up for auto pay.

By signing up for this service, your lender will withdraw your monthly payment on the date you choose.

You benefit by earning a small discount in your interest rate, usually 0.25%

Another benefit is you are never late on a payment, which increases your credit score over time.

Finally, you never have to remember to make a payment, since it is made for you.

The issue though is many people don’t see the benefit in the 0.25% interest rate reduction.

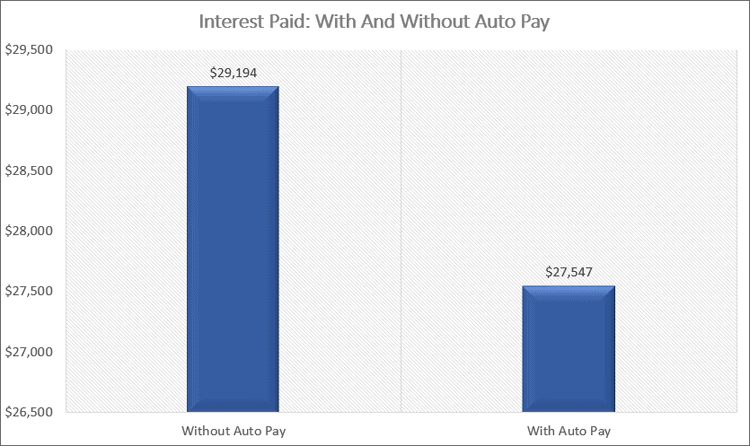

Let’s say you have $50,000 in student loans at 5% interest and are repaying them for 20 years.

You would pay over $29,000 in interest.

With the 0.25% interest rate reduction, you will would pay a little more than $27,000 in interest.

By signing up for auto pay, you would save close to $2,000 in interest.

Be sure to reach out to your loan servicer to see if this option is available to you.

#9. Find Ways To Pay Extra

At the end of the day, the more money you can put towards your student loans, the sooner you will be debt free.

The challenge is to find out how to pay extra on your loans.

There are a few tricks I’ve used and others have used to help.

First is credit cards.

Sign up for a cash back credit card and use it for your everyday spending.

When you do this, you will earn cash back.

At the end of the year, use your cash back balance to pay your monthly statement.

Then take the money you would have paid your bill and put it towards your student loans.

For example, let’s say you have $1,000 in cash back and your monthly credit card bill is $1,500.

You would take your cash back balance and apply it towards your bill, leaving you with just a $500 payment.

You would then take the $1,000 from your bank account and pay your student loans instead.

Another option is to use Qoins.

This is an app that helps you pay down your student loans and other debt you have.

Simply create a free account and link your credit and debit cards.

When you make a purchase, Qoins will round up the total and transfer the difference to a savings account.

When your balance reaches a certain amount, Qoins will use the money and pay your student loan.

Qoins users have paid off over $4 million in student loan debt using their service.

And the average user pays an extra $600 a year on their debt.

Click on the button below to get started!

The best trick though is to use both, Qoins and a cash back credit card together.

Doing this gets you the best of both worlds.

Let’s look at an example.

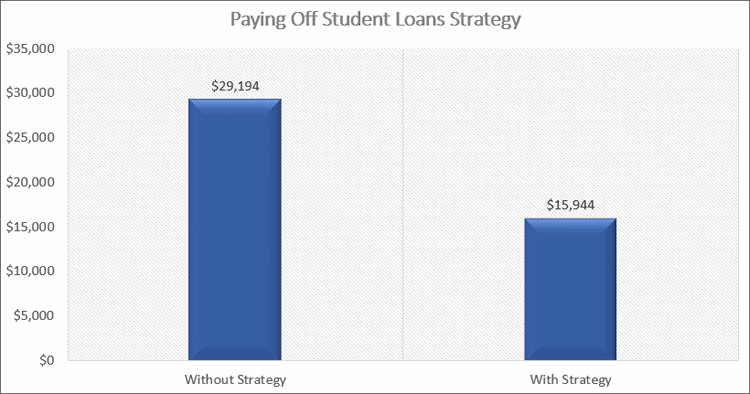

You have $50,000 of student loan debt at 5% interest and are paying it back over 20 years.

If you only make the minimum payments, you will pay over $29,000 in interest over those 20 years.

But let’s say you use this strategy and earn $1,000 a year in cash back rewards and pay an extra $600 a year using Qoins.

You pay less than $16,000 in interest and have your student loan paid off 8 years early!

This is a simple trick that saves you close to $15,000 and you need to take advantage of it.

Of course, there are other things you can do as well to get rid of your student loans faster.

For example, take any windfalls like tax refunds and apply a portion of it towards your debt.

Sell things around your house and use the proceeds to pay down your debt.

The bottom line is, anything you can do to pay extra on your student loan debt will help you get rid of them.

#10. Pick A Different Repayment Plan

If your monthly payments are too high, the federal student loan repayment program offers different repayment plans.

While these won’t save you money, they will make the burden of paying your debt easier.

Some of the most popular repayment plans include:

- Income Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income Contingent Repayment (ICR)

While each one is different, they all work by adjusting your payment based on your income.

This allows you make your monthly payment and still have money left over to survive.

But these aren’t the only repayment plans.

Private lenders offer different types of loan assistance as well.

One of the most popular private student loan repayment plans is income driven repayment.

Here your monthly payment is based on your monthly income.

At the end of the day, your best option is to contact your lender and explain you need help making payments.

They will run through all the various programs to help you out.

#11. Apply For Deferment Or Forbearance

Another option that will help with the burden of student loans is deferment and forbearance.

They both work by allowing you to pause or reduce your monthly payments for a period of time.

People who apply for these programs are going through a financial hardship and need help.

Some examples include unemployment, high medical expenses, military deployment, changing jobs, and more.

To apply for these programs, you need to reach out to your student loan provider.

#12. Student Loan Discharge

Finally, there are circumstances where you have your student debt discharged.

For example, death or total and permanent disability are two situations.

But there are others.

If your school closed while you were attending and you were unable to complete your degree, you can apply for discharge.

The same is true if you drop of college.

The catch in both scenarios is you need to apply within 90 days of the event happening.

You can read more about this here.

How To Pay Off Student Loans In 5 Years

If you have to know how to pay off your student loans in 5 years, here is your plan.

I’ll use the average student loan amount of $32,731 at an interest rate of 4%.

On a 10 year repayment plan, the monthly payment is $331 and you will pay $7,035 in interest.

In order to pay off the debt in 5 years, you need to pay an extra $275 a month.

This will save us $3,621 in interest and free up the $331 we were putting towards our debt for the next 5 years.

So how do we do this?

Let’s assume there are no forgiveness programs that we qualify for and we are not interested in refinancing.

If we sign up for Qoins, we can expect to pay an additional $600 a year or $50 a month.

That leaves us with $225 to come up with.

If we review our budget, we see we can make a few small sacrifices and free up another $50 a month.

That means we still need $175 a month.

Here is where side gigs come into play.

Understand I am not suggesting you work a second job.

But you could do some smaller gigs here and there to come up with the money.

For example, you could take surveys. This would get you close to $100 a month.

You could deliver meals on the weekends for another $100 a month.

Just these options will cover your additional payment and have you debt free in 5 years.

The choice is yours.

There is not magic bullet that will work for everyone.

Read through the list again and try everything that applies to you, and then start taking action.

With a little work, you should be able to pay off your debt in 5 years.

Wrapping Up

There are many things you can do to lower the weight of your student loans.

There is no magic bullet that will wipe out your debt overnight.

However these tips show you how to pay off your student loans and save money.

By far the best option is to use free money to put towards your debt.

This includes having your employer help pay off your loans, qualifying for a forgiveness program, or using credit card rewards.

Aside from that, refinancing is your next best option.

Using these tricks will save you thousands in interest and allow you to pay off your student loans early.

At the end of the day, taking action is the only way you will get rid of your student loans.

Reading this post was your first step.

Now it is time to take the next step and start applying this information so you can pay off your student loans.