THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Table of Contents

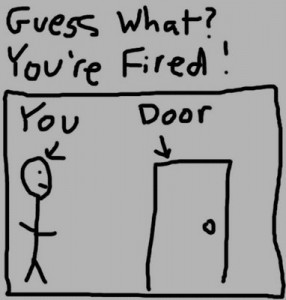

Reasons To Fire Your Financial Advisor

Focus More On Performance Than Your Goals

If your advisor is only focused on performance as opposed to your short and long-term goals, you may want to look for another advisor. While everyone wants investments that perform well, they need to fit with your time frames and tolerance for risk.

Does Not Look At Your Entire Situation

It’s easy for an advisor to help you invest for retirement, but he or she needs to understand your goals. Maybe you are trying to save for retirement and start a family. If this is the case, it changes the advisor’s recommendations for you. Only by looking at your entire picture can one build an investment strategy that will help you to succeed.

Not Reviewed Your Risk Tolerance

This should be a no brainer. If your advisor isn’t taking into account your tolerance for risk, you need to find someone else. Everyone has different tolerances when it comes to risk and an advisor should have done the work to determine yours. But a good advisor will re-assess your risk tolerance every few years to make sure that nothing has changed in our lives that would make us want to take on more or less risk.

Does Not Follow Or Have An IPS

An Investment Policy Statement, or IPS, is basically a guideline as to how your advisor is going to invest your money. Think of it as your game plan. By having this document, you can rest assured that both of you are on the same page. Over time, things will change, such as your tolerance for risk, and this document will need to be updated.

Seems Like A Salesman

If your advisor is only promoting investments that he gets paid a commission on, you will want to look elsewhere. Remember, he is supposed to be looking out for your best interest, not his. If you do not know how your advisor gets paid, it’s time to ask. It should be clearly written down as to what commissions, if any, he gets paid for putting you into certain investments.

Doesn’t Pay Attention To You

Make sure that you feel wanted by the advisor you are dealing with. Many times the relationship will start off great and then slowly your advisor will pay less and less attention to you. While having a personal relationship with every client is difficult to do if the advisor has a large book of business, they should still make the effort to meet with you and review your goals and plan on a regular basis.

Doesn’t Explain How They Are Paid

As an addition to the point above, if your advisor does not or refuses to explain to you how he or she is paid, you need to find another advisor. Any credible advisor will have their fee structure written on paper for you. It may not go into the level of detail you would like, but it will be written down and given to you. If you need more information, just ask. Again, any credible advisor will answer your questions.