THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

When it comes to investing, there are two schools of thought, active investing vs. passive investing.

Knowing which one is right for you is critical to your investing success.

Pick the wrong one and there is a high likelihood you end up losing money.

Pick the right one and there is a high likelihood you end up making money and will be a successful investor.

But which one is right for you?

Only you can answer that question. And this post is going to help you figure it out.

By the time you are done reading this, you will know without a doubt whether an active strategy or a passive strategy is right for you.

From there, all that is left for you to do is open an account with the right broker and start investing your money.

Let’s get started looking at both active management and passive management in detail so you can pick the best one for you and your goals.

Table of Contents

Active Investing vs. Passive Investing: The Best Choice For You

Active And Passive Defined

Before we get into each of these investing strategies in detail, we need make sure you have a solid understanding of them.

In some cases, both investment philosophies believe in Modern Portfolio Theory, which is building a portfolio of assets so the return is maximized for the risk you are assuming.

Passive Investing Definition

Passive investors buy investments that track an underlying index or create an asset allocation and stick to it for the long term.

It believes in the Efficient Market Hypothesis that states all asset prices reflect all available information.

In other words, it believes it is impossible for an individual investor or anyone to beat the market.

For example, investing in a mutual fund or ETF that tracks the S&P 500 Index is a form of passive investing.

If you put your money into the Vanguard 500 Fund (VFINX), you are investing passively.

This is because the mutual fund’s goal is to simply return what the S&P 500 returns every year.

Another form of passive management is setting an asset allocation and sticking with it for the long term.

For example, if you were to pick an allocation of 60% stocks and 40% bonds, you stick with this allocation regardless.

Active Investing Definition

Active investors involve the ongoing buying and selling of individual stocks and other investments.

An active investor purchases investments and continuously monitors their activity in order to exploit profitable conditions.

The goal if active investing is to earn as high of a return as possible.

It also can mean changing your allocation based on what the market is doing.

For example, in terms of buying and selling, you are looking to make a short term profit on the price swings of an individual stock.

You actively are trading investments either daily or weekly in an attempt to maximize profits.

- Related: Click here for 5 day trading rules you need for success

- Related: Learn why market timing rarely works out for investors

Another form of active management is changing your asset allocation.

For example, you might have an allocation made up of 60% stocks and 40% bonds, but fear a recession coming.

As a result, you reduce your stock exposure to 40% and increase your bond holdings to 60%.

Doing this will help protect your money from losses should the stock values drop.

Now that we know the differences between the two investing strategies, which strategy is the better long term option for your investment dollars?

Active vs. Passive Portfolio Management

As with anything in life, there are advantages and drawbacks to both passive and active investment.

I won’t go through the entire list as some of them can get fairly technical.

Instead I will keep it basic and only cover the most important points for both.

Active Investing Advantages

#1. Potential For Higher Return

Since active investing involves the buying and selling of investments, you can potentially earn higher returns than the market if you are able to find some undervalued stocks and make the right trade at the right time.

This annual return could be much higher than the market in any given year.

#2. Professional Management

Actively managed mutual funds are run by a team of managers that oversee the funds and make decisions when to buy and sell.

Since the active fund manager is educated in finance, many people think they have a higher probability of beating the market and thus higher potential returns.

In a minute you will see if their track record backs this belief up.

#3. Ability To Play Defense

When the stock market turns south, an active manager of equity funds is able to play defense to some extent.

This means they can sell off some riskier investments and instead invest in safer holdings, like bonds or cash.

The changing of the asset class can help protect gains and limit losses.

Active Investing Disadvantages

#1. Typical Below Average Return

While I noted above that the managers are educated in finance, many people believe they should be able to beat the market.

While I noted above that active fund managers are educated in finance, many people believe they should be able to beat the market.

Unfortunately, they don’t.

In fact, it is rare for active managers to consistently outperform the market.

They may do so here and there, but not every year.

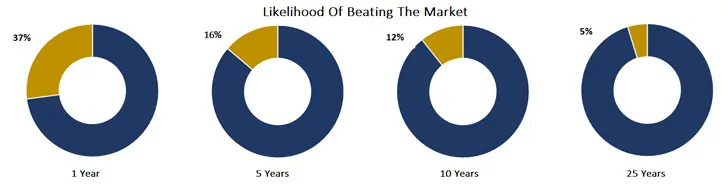

Here is a great chart showing the likelihood of beating the market in one year, over 5 years, over 10 years and over 25 years.

As you can see, as you invest for longer periods of time, your chances of consistently beating the market dwindle.

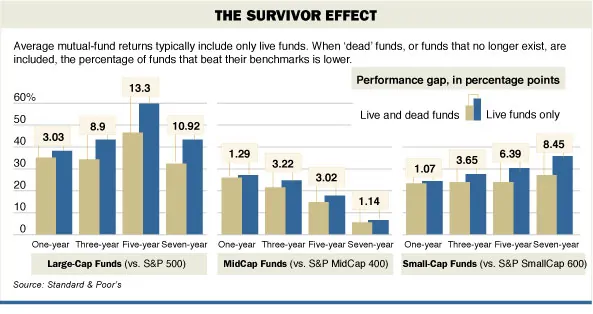

Here is another way to look at the difficulty of consistently beating the market.

It is called survivorship bias.

When most studies are done that look at the percent of funds that beat the market, they only look at funds that are currently in existence.

But every year, mutual funds are closed due to under performance.

When you take these closed funds into account, you get a true picture of the chances you have of beating the stock market.

Below is a great chart from Stands & Poor’s showing just how difficult it truly is to outperform the market consistently.

At the end of the day, your best odds at beating the market are to stick to large cap equity funds.

But even then, you have less than a 50% chance at success as future performance is known.

#2. High Fees

Because of professional management, actively managed funds tend to have higher expense ratios, otherwise known as fees, since you are paying for the professional management.

This eats into your returns over the years.

A little later in this post, I’ll give examples showing just how much these higher costs effect your wealth.

#3. Higher Taxes

With an active approach to investing, you run the risk of paying more in taxes.

This is because you will realize more capital gains over the short term.

And since short term capital gains are taxed at a higher rate than long term gains, you could face a higher tax bill.

Passive Investing Advantages

#1. Low Cost

Passive funds don’t have professional managers that need to pay attention to the market and make trades and modify holdings on a regular basis.

They simply invest as the underlying index is set up.

Therefore, the management fees are much lower, which pays off in the long run.

#2. Get What The Market Gives

You are never earning less than what the market returns when you invest passively.

You are always going to get what the market returns, be that good or bad.

#3. Simplicity

A passive investment strategy is simple.

You pick an allocation and some passive mutual funds or exchange traded funds and you are pretty much done.

You don’t have to monitor the market daily to make any changes or try to take advantage of price swings.

#4. Tax Efficiency

When you invest in a passive investment approach, you lower the chances of getting a high tax bill.

The reason why is because the funds mimic the index they are tracking and very rarely do the holdings change.

This means there is a lot less trading happening by the portfolio manager.

And as a result, the lower the chance of you paying taxes on capital gains.

Understand this isn’t to say you will never pay capital gains taxes.

Just that the amount you pay will be less.

Passive Investing Disadvantages

#1. Never Return More Than The Market

While a benefit is always earning what the market does, you never beat the market with passive strategies.

To some, this is an issue, but if the market returns on average 8% annually over the years, that is a solid return.

#2. Lack Of Action

When the market drops, you are stuck with your allocation and investments since you aren’t trading based on what the market is doing.

To some, this makes investing boring.

Common Misconceptions

There are two common misconceptions that most investors have when it comes to active management and passive management.

#1: Higher Fees Means Better Performance

For active strategies, many investors assume that the higher fee they pay means better performance.

After all, we’ve been told all of our lives that you get what you pay for.

Unfortunately, this is not the case when it comes to investing.

As I noted above, most professional fund managers can’t outperform the market on a regular basis.

So why pay them more for mediocre performance?

Don’t make the mistake of thinking paying more for your investments means better performance or a higher return.

It doesn’t work that way.

You are better off paying a lower fee and taking the return the stock market gives you.

Here is why.

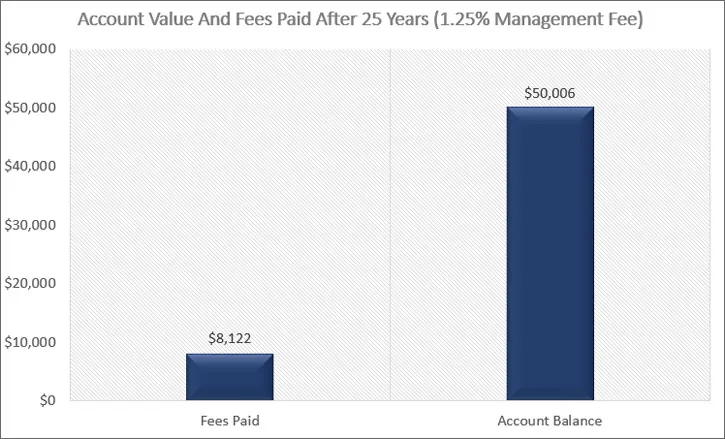

Let’s say you invest $10,000 for 25 years and the investment earns 8% annually. But it has a management fee of 1.25%

After 25 years, you have roughly $50,000 invested and you have paid a little more than $8,000 in fees.

On the surface, this might not seem like a big deal.

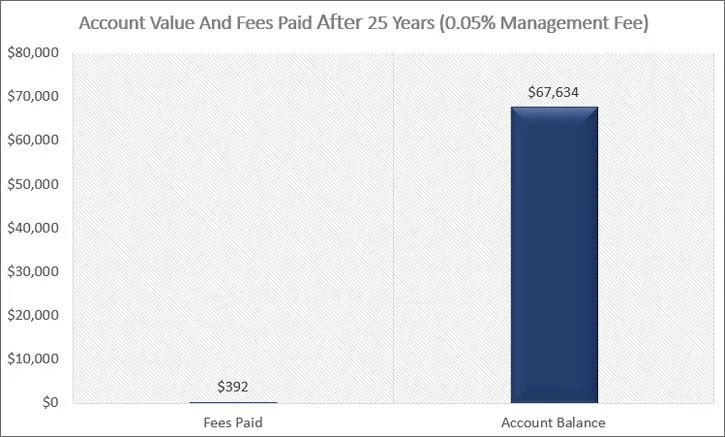

But let’s run the same scenario only this time you pay a management fee of 0.05%.

After 25 years you have over $67,000 invested and you have paid $392 in fees.

Now you see why fees matter.

By making the choice to pick the fund with the lower management fee, you saved yourself over $7,700 in lower fees and your account value is over $17,000 higher.

The reason the account value is so much higher is because more money stayed invested and was able to compound and grow.

#2: Buy And Hold Means Set And Forget

For passive investing, many investors assume once you set up your portfolio you are done and never touch things again.

This is wrong.

Even with a buy and hold mentality, you still monitor your investments and make adjustments as the market moves.

This is called rebalancing.

When stocks rise in value, bonds tend to fall. So your 60% stock, 40% bond portfolio is now a 70% stock, 30% bond portfolio.

You need to make adjustments to get it back in line.

Otherwise you take on too much or too little risk and end up not achieving your goals.

While passive investing involves less work, there is still some monitoring that needs to be done.

Which Investing Strategy Is Better Long Term?

Over the long term for most investors, a passive investing investment philosophy is the better choice because you have a higher probability of success.

The fees you pay are lower and you are always getting what the market returns.

And you never underperform the market.

This one is huge because as smart as we think we are, most of us end up being an average stock picker.

This means you are more than likely to end up with an annual return lower than the market.

While it is true you don’t take a more defensive stand when the markets drop, consider this.

Most investors can’t time the market anyway.

They sell too late after a drop and they buy in too late after the rise.

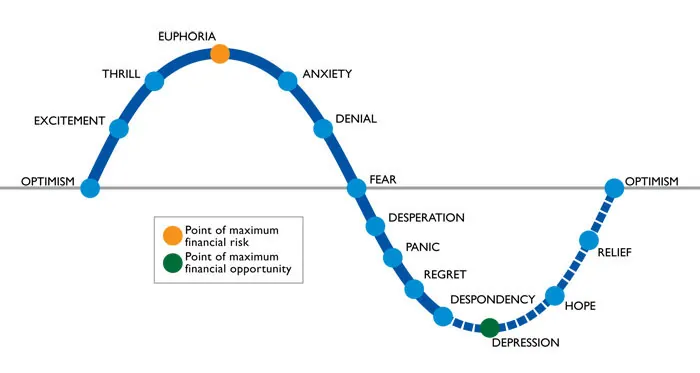

Here is a great graph showing the emotional roller coaster most investor’s experience.

The average investor will sell around the time of panic, which is after most of the losses have occurred.

Just as bad, they won’t buy back in until most of the gains have been realized.

Look at recent history as another example of this.

Stocks bottomed during the Great Recession in February 2009.

Most investors had just gotten out after market conditions were at their worst.

But then the market turned around and started its recovery.

From 2009 through 2012, it was up close to 60%.

Since the lows of 2009, the stock market is up over 500%!

This means if you had stayed invested during this entire time, you would have earned all of your losses back and made a lot of money.

Yet most investors still were too scared to invest.

And before you think professional investors have better luck, think again.

Remember the charts from above?

They cannot consistently beat the market over time.

They can do it for a year or two, but always revert back to the mean and underperform.

Why bother chasing returns of active management when you can make your life that much easier by investing passively?

Interestingly enough, you will find studies talking about the benefits of active investing.

Sadly, these studies are all funded by Wall Street.

All of the independent studies done on the subject conclude that passive investing is the smarter choice.

And why does Wall Street want you to invest actively?

Money!

It’s all about the money.

The more you trade, the more they make in trading fees and commissions.

Even if you are in a mutual fund and aren’t doing the trading, the fund manager is and is paying fees.

And don’t think for a second those fees aren’t passed on to you.

So why do many investors choose active management?

It is the sexier choice.

People want to talk about how their investment grew 20% last year.

No one wants to hear about passive investing.

It isn’t glamorous. It’s very boring.

But just like the fable of the tortoise and the hare, the winner isn’t the sexier choice.

Which Investment Strategy Is Right For You?

I will admit that I am biased towards passive investing.

Why spend all the time researching and picking stocks, then having to keep current on what is happening in the market when you can just invest and forget about it?

When I think about my free time outside of work, I would rather spend it with my friends and family than researching stocks and figuring out my next trade.

If you feel the same way, then investing passively is the best option for you.

If on the other hand, actively researching stocks and trading all day interests you, then active management is the best option for you.

Let’s look at how to get started with both options.

How To Get Started With Passive Management

You’ve decided that passive investing if the right choice for you.

Now you have to figure out the best way for you to get started.

All that is involved in a passive investing strategy is picking out the right investments and setting up an automatic investment plan.

You can go about this in one of two ways:

#1. Invest with a robo-advisor

#2. Do it yourself

Investing with a robo-advisor is a perfect option for the majority of readers because it takes most of the work out of your hands and allows the advisor to do the work.

All you have to do is answer some questions so you can be placed into the right portfolio for your goals, and then set up an automatic investment plan.

My favorite robo-advisor is Betterment.

They make investing easy for you and they are innovative.

Just take 10 minutes and Betterment will put you in the right portfolio based on your goals and risk tolerance.

All that is left for you to do is to set up a monthly investment amount.

Then Betterment will invest your money, rebalance your portfolio, and reinvest dividends for you.

There is nothing left for you to do!

To get started with Betterment, click the link below.

If you want to invest on your own, then I suggest you follow a basic three fund portfolio.

You may also hear this called a lazy portfolio.

By investing in a three fund portfolio, you will be fully diversified and will be able to easily stay on top of your investments.

Just be certain your passive investment portfolio includes the following:

- S&P 500 Index Fund

- International Stock Index Fund

- Total Bond Fund

Once you have this passive investment portfolio set up, all that is left to do is add new money on a regular basis.

The best place to set up your own passive portfolio is with M1 Finance.

Open your account, pick your investments and a monthly investment amount and you are done.

To get started with M1 Finance, click the link below.

How To Get Started With Active Management

To get started with active investing, you have to make a decision first.

You need to decide what active investment strategy you are going to follow.

I’ll keep things basic and only talk about fundamental analysis and technical analysis.

Fundamental Analysis

In a nutshell, fundamental analysis involves analyzing a company’s financial statements.

This allows you to see how the business is performing, including:

- Are sales increasing or decreasing?

- Have assets receivable increased or decreased?

- How has inventory levels changed over a few years’ time?

You can then begin calculating ratios and comparing those to other firms within the same industry.

This will give you something to compare the numbers against.

You will be able to quickly see if the company you are analyzing is performing better or worse than its competition.

From there, you move away from calculations and have to look more at the business as a whole as well as the economy.

You may be looking at a company with strong financials, but is it in an industry that is evolving.

For example, look back at Blackberry.

They owned the smartphone arena. They focused solely on corporate clients.

But Apple and Google entered and targeted consumers and slowly worked their way into corporate America.

Now, Blackberry is struggling to survive.

Looking only at their financials, you might not see the struggles coming.

But after analyzing the landscape, you might have seen the proverbial writing on the wall.

In order to perform fundamental analysis correctly, you need to look both at the financials of the company as well as outside events to determine if a stock is a buy or not.

Technical Analysis

Forget everything I just told you about fundamental analysis.

None of it applies to technical analysis.

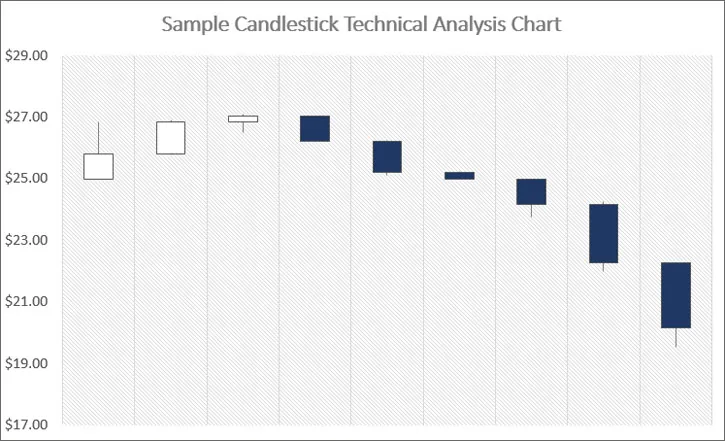

Technical analysis is the process of studying the chart of the stock price of a company to determine if the stock is a buy or not.

Technical analysts are often referred to as “chartists” because they study charts to find investments.

They study the charts to look for trends and patterns to determine when a stock is trading for less than it should be.

These price fluctuations help traders determine when to buy and sell.

Additional techniques used by technical analysts include moving averages, regressions, relative strength index, and business and market cycles.

The belief is that emotions are present in the stock market and that the market repeats itself.

By studying charts, the hope is to identify the points when history is going to repeat itself, act on it, and profit from it.

Once you determine your active investment strategy, the only thing left for you to do is find the best broker for you.

My pick for best broker for active traders is Webull.

I like them because they offer free trading of stocks.

In addition to free trades, they also offer endless tools for stock picking, which an active trader needs to be successful.

To get started with Webull, click the link below.

The Must Have Tool For All Investors

Before I wrap up this post, I want to mention a tool that any investor, regardless of which investing philosophy you choose, needs to use.

It is called Personal Capital.

Why do I encourage you to use it?

It gives you insights into your investments and portfolio that you can’t get anywhere else for free.

I used to work for a high net worth planning firm.

We offered our clients a lot of tools to help them with their investments and everything we offered, Personal Capital offers.

The difference is that to get access to these tools with us, you needed to be a client.

This meant you needed to be investing millions of dollars with us.

With Personal Capital, you don’t need to invest anything with them. Or pay them.

The service is 100% free.

Here is a list of what you get at no charge:

- Portfolio review

- Investment checkup

- Retirement planner

- Investment fee analysis

- Net worth tracker

- Budget

- And more!

This app is as powerful as you can get and I can’t say enough positive things about Personal Capital.

To get started and open your free account, click the link below.

Frequently Asked Questions

This topic is a hot debate between individual investors and as a result, new investors trying to decide between the two have a lot of questions.

Here are the most common questions I get on active vs. passive portfolio management.

Are mutual funds actively managed?

Most mutual funds have active management, but there are a good number of index mutual funds out there.

The same holds true for exchange traded funds as well.

What is an index fund?

Index funds is another term used for investments that are have the passive trading characteristic.

So if you hear someone talking about passive index funds, know they are talking about a passive investing strategy.

Does one investment strategy limit my investment choices?

No.

There are many investment options for investing strategies.

So regardless of what strategy you choose, you can build a portfolio that fits your needs.

Is active investing better than passive?

This depends on your goals and interests.

If you are interested in active trading, then actively investing your money is better for you.

But the majority of investors will do just fine with a passive approach to investing.

Do active funds outperform passive funds?

Some active funds outperform passive funds on a year by year basis.

However over a long period of time, passive funds tend to outperform active funds.

So while an active mutual fund may beat the market one year, the odds it does it the following year is slim.

This is why it is so hard to earn a higher return than the market.

You essentially have to guess which funds will do good for the year before it happens.

What philosophy does a financial advisor use?

This depends on the advisor.

Some believe in active investing and will buy and sell frequently on your behalf to try to earn a return higher than the market.

Other advisors believe in a passive approach and will invest your money in index funds and ETFs.

Wrapping Up

At the end of the day, the debate between active investing vs. passive investing will never end.

You will always have people in favor of one or the other investment styles.

But what is most important is that you pick the investing strategy that is the right fit for you.

As I mentioned, I am all about index investing.

I would rather invest passively and spend my free time with friends and family.

I have a friend who loves charting and finding undervalued stocks.

Doing this excites him and he makes money doing this.

But it is a lot of work.

As long as you pick the right strategy for you, you greatly increase the odds of success and you building your wealth by investing in the stock market.

I am definitely a passive investor. Originally not by choice, but because I didnt know enough about investing to be an active investor. But now that I have read your post and understand the difference, I will remain a passive investor beacuse of the things you shared and because it has always worked well for me. Thanks for the great post! I will be checking back often!

There is a lot to be said for passive investing. The results are good and the time commitment is minimal.

Loved this post, very informative, thanks for sharing!

I am also a passive investor. If professional active guys underperform the vast majority of the time, I see no reasonable way I can do better. In actuality, passive, index investing will outperform the majority of the active guys every year. I’ll take that

Makes perfect sense BEM.

That’s the funny thing. Active managers rarely beat the market on a consistent basis, yet so many people still invest in those funds. My guess is because most investors simply look at the return of the fund in question and not the index, or just read an article about a ‘hot’ stock and buy in because it is ‘hot’.

I learned this the hard way. I was with an advisor who preached active management, and in a 2 year period, I didn’t really see any benefits. I have since changed advisors and the passive approach seems to be a better long term strategy.

Sounds like you have learned a good personal finance lesson.

When I first began investing, I bought into the active management style myself. I think most of us do since it’s so glamorous to think we can earn a higher return. Sadly, it rarely turns out that way.

I figure the only people getting rich on “active investing” are those who get paid when you trade. Far easier on the blood pressure to buy well and hold long term.

Good common sense advice though.

Investing for the long-term is easiest when you ignore the media with their hype regarding the market over the short-term. Prepare a plan that will help you meet your goals and stick to it!

Who needs sexy!?!? I’ll take the returns… I once ran the numbers and if it takes you 4 hours per week to beat the market by 2% (not easily accomplished) on a 50,000 portfolio then you’re making less than $5 per hour for your time (before taxes!).

I’ll take passive investing for the vast majority of my $$. I have a few bucks that I play with but just a few and money I’m fully prepared to lose.

My time is worth much more than $5!

I too have an account with play money. I still don’t devote much time to it and am OK with losing all of it. Luckily though that hasn’t happened yet!

Simple index ETF’s FTW. Matches the index they are tied to, ultra low expenses and no need to worry about a trader blowing up the account.

Love it!!

I like passive investing because active management can’t beat passive consistently anyway. Most of my mutual funds and ETFs are passive index. My dividend portfolio are comprised of individual stocks and I’m mostly inactive there as well.

It sounds like you know what you are doing.

I keep my active investing for my small business endeavors I work on, not the stock market.

I’ve been a passive investor but I’ve been trying to get a more concrete understanding of why you want a bond/stock ETF mix if you’re not touching the account for decades. Most research just comes up with “it helps stabilize your investments” but isn’t that only relevant if you’re touching the money within the next 10 years? I’ve also heard an idea about when you re-balance the mix you are essentially buying low and sell high over time.

Any Thoughts?

I always like to do a little bit of both (active vs passive). Keep the index funds in the ROTH IRA/401k and have some dividend stocks in the taxable brokerage. I’d agree that the way to go for the absolute long term is finding the lowest expense ratio funds you could find and ‘set-it and forget’.

Rich