THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Do you wonder if you are getting ahead and making progress on reaching the financial dreams you have?

Are you scared that you will wake up one day, wondering how you got to the financial place you are in?

If you calculate your net worth, you will never feel lost with money again.

You will also have a guide showing you how you are improving your finances over time.

This will help you reach your financial dreams.

In this post, I am going to show you why you need to track your net worth so you can increase your wealth.

I’ll also show you tips to increasing assets and decreasing liabilities.

The end result with be a master plan for you to start calculating your net worth so you can achieve your dreams.

Table of Contents

Your Complete Guide To Calculating Net Worth

Why Track Net Worth?

Tracking your net worth gives you an idea of your financial progress.

When you earn a paycheck and then spend your money, you have no idea if you are getting ahead or falling behind.

But by having a formula to see your financial progress, you will know where you stand and where you can improve.

And by taking the time to calculate your net worth, you will become a smarter person with your money.

The end result will be you increasing the odds of reaching your financial goals.

The Net Worth Formula

The net worth formula is a simple calculation that you can do with or without a calculator.

In fact, the most time consuming part is getting all the numbers you need to do the math in the first place.

To calculate your net worth, you add your assets and subtract your liabilities.

Net Worth = Assets – Liabilities

That’s all there is to it.

Note that your net worth can be positive or negative.

When it is positive, it can be a sign that you are living below your means.

You should continue to increase your wealth if you stick with it.

When it is negative, it means you are living beyond your means.

You need to review your spending and get better at saving money so you can increase your wealth.

To calculate your net worth, you can do it on a spreadsheet or just a piece of paper.

There are even apps out there now that calculate your net worth for you.

While the net worth formula is easy to calculate, we need to understand what are assets and liabilities.

This will ensure you are using the right numbers in your calculation.

After all, if you are using the wrong numbers, the answer won’t be of much value.

Understanding Components of Net Worth: Assets And Liabilities

To understand the importance of net worth, we have to look at both assets and liabilities since they both affect our bottom line.

What Is An Asset?

An asset is anything you own which has value.

This includes cash and investments, but also your house, personal belongings, etc.

The trick here though is assigning the right value to non-cash assets.

You need to use the fair market value.

For a home, this is easy. You can use a site like Zillow to estimate the value of your house.

For your personal belongings, this is harder.

You need to estimate what someone would be willing to pay for them.

So in summary, your assets include the following:

- Cash

- Investments (both retirement and non-retirement)

- House (fair market value)

- Car (fair market value)

- Personal belongings (include clothing, electronics, furniture, etc.)

- Art

- Baseball card collections, collectibles, etc.

When you are first calculating your net worth, take your time to make sure you include all your assets.

This ensures your net worth number is accurate.

How To Increase Assets

Increasing assets is a smart way to increase net worth.

The easiest way to increase assets is to save and invest more money.

The more you save and invest, the more you will be increasing wealth.

As a result, the higher your net worth will be.

And in time, it will grow faster.

This is because you will be earning interest, and that interest will earn more interest.

There are many ways to save.

But my favorite is to pay yourself first.

By making sure you save money the moment you earn it, you will grow your net worth.

And you don’t need to make this more complicated than it needs to be.

Just set up a monthly transfer to a savings account and forget about it.

You can even do the same thing with investing.

By automating, you will put money aside every month without any work on your part.

And before you know it, your wealth will be growing faster than you thought possible.

What Is A Liability?

Typically, banks consider liabilities as debts and other obligations someone owes.

I like the cash definition that a liability is anything that takes cash from your pocket.

This includes anything you owe money on, like student loans, your mortgage, and your car loan.

When calculating your liabilities, you want to take your current loan balance.

The good news is that this number should be dropping every month as you make payments.

In summary, your liabilities include the following:

- Credit card debt

- Mortgage

- Car loans

- Student loans

- Personal loans

When you first calculate your net worth, make sure you include all of your liabilities.

Again, this is so your net worth is correct.

How To Decrease Liabilities

Decreasing liabilities is a great way to increase net worth.

By paying down your debts, you lower your liabilities, freeing up money every month.

So what are some great ways to decrease liabilities?

Simply put, you need to be smarter with your spending.

Review where your money goes and cut out wasted spending.

By living within your means, you won’t be adding to your debt balances each month.

From there, you need to start attacking your debt.

I prefer the debt snowball method when it comes to getting out of debt.

It works by organizing your debts from smallest balance to largest.

You then pay the minimum on all your debt except the smallest one.

For the smallest one, you pay as much as you can.

Once you pay it off, you follow the same plan for the next smallest debt.

Doing this keeps you motivated and helps you to see results.

There are a couple of tools I recommend as well to help you decrease your liabilities.

First is Qoins.

This is an app that rounds up your purchases and saves the spare change.

Then you tell Qoins what debt you want the savings applied to.

Qoins has paid off over $4 million in debt and the average user pays off and extra $600 worth of debt a year.

All from their spare change!

The other tool is Credible.

Here you can refinance your student loans or credit card debt into a lower interest loan.

The benefits here are many.

First, you save money by having a lower interest payment. This means you will save thousands as you pay off your debt.

Next, with a lower interest rate, more of your monthly payment will go towards your balance.

This will help you to pay off debt faster.

Finally, by combining your debt into one loan, you make paying your debt a lot easier.

Easiest Ways To Track Your Net Worth

Now that you know the net worth formula and how to calculate your it, what are the best ways to track your net worth?

There are a handful of options out there for you. I’ve broken them down into 3 main areas.

Manual

Grab a pen and piece of paper.

On the left side of the sheet, write out your assets based on the list above and on the right side, list out your debts.

At the bottom, total them up and subtract your liabilities from your assets.

Spreadsheet

If you don’t want to do the math, you can download this free template I created.

All the categories are listed for you.

All you have to do it type in some account names so you can follow along and enter the values.

No math here because I have set up formulas to do it all for you!

Software

The best option in my opinion, is to use Personal Capital, which is free to use.

Just link your accounts and they do the rest for you.

Every time you log in, you net worth will be updated to the minute.

I use this and love it. It offers a lot more features too, but for this post, I’m just focusing on the net worth part.

Be sure to add in the value of your house to get a true number.

Frequently Asked Questions

I get asked a lot of questions about net worth, so I created this FAQ section that answers most of them.

What is liquid net worth?

Liquid net worth is much like your personal net worth.

The main difference is on the asset side.

Instead of taking into account all your assets, you only account for liquid assets.

These include cash and investments, like stocks, mutual funds, etc.

You then subtract out your liabilities and you have your liquid net worth.

Many people prefer to calculate their liquid net worth because they feel this is a truer number.

For example, you aren’t going to sell your house or your belongings in the event of an emergency.

You would sell your investments first.

What are assets that depreciate in value?

There are a few things we classify as assets but depreciate in value.

One example is your car.

As you drive your car, it loses its value. So while it is an asset, it is not something that will grow in value over time.

Because of this, you want to avoid having too many assets that lose value.

This is another reason why many people prefer liquid net worth.

Your overall net worth can be skewed if you have a lot of assets that depreciate in value.

What are income generating assets?

Income generating assets are things that produce an income for you.

A savings account or dividend paying stocks are two example of income generating assets.

Each month with your savings account, you earn interest. And every quarter, your dividend paying stocks pay you a dividend.

In the beginning, the income you earn will be small, but in time, the income you earn will grow in size.

Another income generating asset is rental real estate.

As long as you are turning a profit after all expenses are paid, you have an income generating asset.

Is my house a liability?

This is a hot topic and depends on who you ask.

On the one hand, your house is an asset because it provides an income in the sense you can sell it for cash.

Additionally, your home’s value will increase in time.

But, owning a home adds a lot of monthly expenses to your budget.

It is this reason why some people see a house as a liability.

You need to decide how you view your house and then calculate your net worth based on this.

How frequently should I calculate my net worth?

This is up to you.

Some people choose to calculate their net worth twice a year.

I calculate my personal net worth monthly. I like to see the monthly change to keep me motivated.

But for others, this might have the opposite effect.

Not seeing a lot of progress can derail your motivation. For these people, quarterly or semi-annually is a better choice.

I suggest you start out quarterly and make adjustments as you see fit.

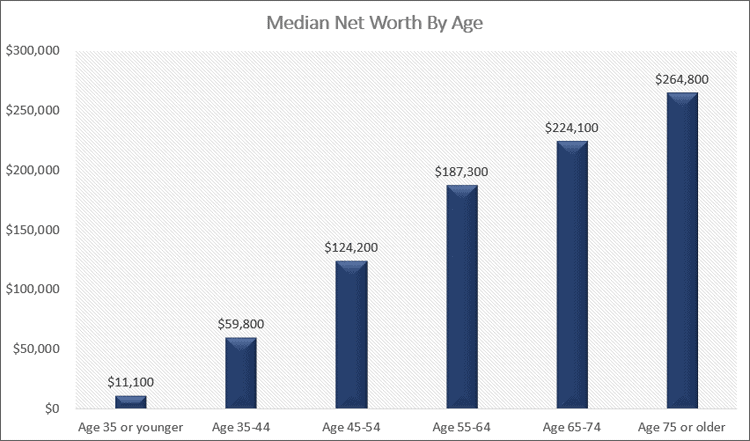

What is a good net worth by age?

There are various factors that come into play that make this hard to answer.

For example, people live in different areas, each having their own cost of living.

A person living in New York City will have a higher cost of living than someone living in Kansas City.

Also, careers matter here. Earning $125,000 a year versus $50,000 is going to have an impact on net worth.

Finally, when did you start working? Depending on when you start earning a salary will have an impact on your net worth.

As a result, we can’t say you should have this amount by a certain age.

But we can use rough guidelines.

Below is the median net worth of US households.

Remember to only use this as a rough guide.

Don’t fall into the trap of thinking you are doing great if your net worth is higher than the reported number.

Your goal should be to have the net worth that will allow you to achieve your financial and life dreams.

Wrapping Up

Calculating your net worth is an important way to increase your wealth.

It also helps you to see how you are doing financially.

While your net worth number may be disappointing, seeing where you are helps you know where you need to go.

Plus it will help you with how to get there.

And by making it a point to calculate your net worth a few times a year, you will see the progress you are making.

One final point just to make it clear.

Don’t focus on one side of the equation.

Look at both assets and liabilities when trying to increase your net worth.

Over the long-term, great financial health comes from focusing on both assets and liabilities.

Yep, I do track my/our net worth; and really enjoy seeing it going up, and up…This is how I started calling our debt ‘negative wealth’ – it is technically correct, save me using the ‘d’ word and focusing on it (you get what you focus on, right?) and make me different. I also think that Control Your Cash have got it really right – sell liabilities and buy assets is the way to a wealthy life full of joy.

I like your ‘negative wealth’ term.

I don’t do this but I’m going to start now! Always been a bit nervous of doing so in case I get bummed out by the result, but you’re right – it’s better to know which direction you’re headed in so it can be changed if need be!

Well, glad that you are getting started. Let us know how it goes.

I do my “financial Month End” every month too. Just to make sure I am on track.

Question – are my kids Assets or Liabilities – discuss LOL

Biggest liability; trust me on this one. Well worth it though.

I track my net worth each month as well as my debt/equity ratio. It’s really awesome to watch your % of debt decrease as you are tracking your net worth. It’s also nice to look back at each month and see from a year or two back how much progress you have made in your debt and your net worth.